Indiana Prenuptial Agreement

Congratulations on tying the knot (or considering tying the knot) in sweet home Indiana! Go Hoosiers! Before you dig into that pork sandwich with a side of corn, consider this: Indiana will likely assume all of your property (whether purchased before, during, or after marriage) as shared property… unless you have a prenup. In other words, that retirement account you’ve had since you were 21 may be divided up in a divorce unless you say otherwise in a prenup. Keep reading to learn more about Indiana’s prenup laws.

Indiana Prenuptial Agreements

The Indiana courts refer to a prenuptial agreement as a “premarital agreement.” A premarital, antenuptial, and prenuptial agreement is all the same: a legal contract drafted between two parties before getting married. A prenup is only valid after the marriage takes place. Indiana’s Premarital Agreement statute and case law govern the laws in Indiana pertaining to prenups and outline the rules and requirements for a valid agreement. The terms of an Indiana prenup may include alimony, property division, attorney’s fees, retirement accounts, and more. On the other hand, a prenup in Indiana cannot limit or contract around child support or child custody.

What to include in a valid Indiana Prenup

For an Indiana premarital agreement to be considered valid, you should consider the following:

- Must be in writing

- Terms must not be unconscionable

- Must be signed by both parties (HelloPrenup recommends initialing each page)

- The contract must be signed at a reasonable amount of time before the wedding (not last minute)

- Full disclosure of assets and income (it is recommended to attach a written statement of assets and income to the prenup)

- It is highly recommended that each party hires their own attorney if they desire legal advice or representation

What to exclude from your Indiana prenup

To ensure that your prenup comports with Indiana law, make sure not to include…

- Terms involving child support

- Terms involving child custody

- Unconscionable terms

- Terms that violate public policy

- Terms eliminating or modifying spousal maintenance (a.k.a., alimony) that causes one spouse extreme hardship

The agreement must also be executed voluntarily and freely. This means that either party had a meaningful choice whether to sign the agreement and they were not physically or psychologically threatened.

What does unconscionable look like in America’s heartland?

In Indiana, what does unconscionable really mean? A case from 1991 helps us understand this. Husband and Wife executed a prenup that stated, in the event of divorce, Husband would pay Wife alimony (a.k.a. maintenance) of $500,000, plus $500/week during the divorce proceedings. At the time of the prenup, Husband’s net worth was in upwards of $31 million.

The couple divorced a few years later, and Wife sought to enforce the prenup to no one’s surprise. Unfortunately, before the divorce was filed, Husband lost all of his money and declared bankruptcy. At the time of the divorce, his net worth was about $300,000, with an annual income of $50,000.

The big question is, should Husband still have to pay Wife the alimony promised in the prenup, or does his current monetary situation alleviate the need to pay her? The court said that the change in financial circumstances rendered the agreement unconscionable. It reasoned that if the alimony from a prenup leaves a spouse in a position where they don’t have enough money to even provide for themselves, then the court may invalidate the prenup. Makes sense!

Justus v. Justus, 581 N.E.2d 1265 (Ind. Ct. App. 1991)

Statutes & terms to understand for a Indiana Prenup

*Before diving into the deep end, let’s go through some terminology and phrases that will be used in your prenup – that way, you don’t go cross-eyed trying to decipher the legal jargon and miss something.

In Indiana, a divorce is referred to as a “dissolution of marriage.” A dissolution of marriage occurs when two people, who have been legally married, begin the court process to end the marriage. You may file for divorce in Indiana under no-fault grounds or limited fault grounds. Fault means that you can file for divorce based on the evidence that one spouse “did something wrong.” No-fault means that you can file for divorce based on the claim that the marriage simply is no longer working out, claiming an “irretrievable breakdown of the marriage.”

>>For the entire fine print, review Indiana Code Section 31-15-2-3

To disclose or not to disclose

Many states require couples to fully disclose their financials prior to signing a prenuptial agreement. Does Indiana agree? Let’s find out from Craig and Tammy’s story. Craig was 40 years old, an elementary school teacher, and a pilot. Tammy was 27 years old and a secretary. They executed a prenup that said each party would treat their property acquired before the marriage and any property under their own name as separate property. This prenup did not include a detailed financial statement.

Craig had about $130,000 in retirement funds at the time of the wedding, and Tammy had a car and some furniture. Craig claimed he verbally expressed to Tammy he had between $100,000 and $150,000 in assets. Tammy disagreed; she said he never told her that.

Tammy was caught cheating about four years into the relationship, and Craig filed for divorce. Craig wanted to enforce the prenup to keep his $130,000 in assets. Tammy sought to invalidate the prenup to have those assets divided in the divorce. Tammy argued that the prenup is invalid because he never provided full and fair disclosure of his financial assets.

What did the court think? The court sided with Craig. It declared that as long as the prenup is entered into freely, without fraud, duress, or misrepresentation, and is not unconscionable, it will be valid and binding. There is no need for financial disclosure for an Indiana prenup, which is a shift away from many states’ laws surrounding prenuptial agreements. To be extra safe, HelloPrenup always recommends financial disclosure. It would never hurt you to add a financial statement to the prenup, but also good to know it’s not totally necessary.

Hunsberger v. Hunsberger, 653 N.E.2d 118 (Ind. App.1995)

Divorce Statute

Term used for divorce: “dissolution of marriage”

In Indiana, a divorce is referred to as a "dissolution of marriage." A dissolution of marriage

occurs when two people, who have been legally married, begin the court process to end the

marriage. You may file for divorce in Indiana under no-fault grounds or limited fault grounds.

Fault means that you can file for divorce based on the evidence that one spouse "did something

wrong." No-fault means that you can file for divorce based on the claim that the marriage simply

is no longer working out, claiming an “irretrievable breakdown of the marriage.”

>>For the entire fine print, review Indiana Code Section 31-15-2-3

How to end a marriage in Indiana

Only one party needs to begin the process of ending a marriage (but don’t get us wrong, it takes two to make it work!) If one party wants to end the marriage, it is within their sole right to do so, and the other non-participating party does not have to agree in order to begin the process. If a non-participating spouse does not partake in the proceedings, a default judgment will be entered and force the divorce to proceed.

There are two ways to end a marriage in Indiana: annulment or dissolution of marriage. An annulment ends a marriage based on the idea that it was void from the start (think: underage, bigamy, cousins). You may also obtain a legal separation, but a legal separation does not technically end a marriage. Legal separation allows for court orders, such as maintenance, child custody, and child support, but you are still married at the end of the day.

Residency requirements

Each state has residency requirements that must be fulfilled before you can divorce in that state. In Indiana, these are the residency requirements:

- Either spouse must be a resident of Indiana for at least six months before filing for divorce.

Separate Property

Official term for property not considered part of the marital estate

Separate property means property that does not get divided in the divorce. On the other hand, shared marital property does get divided in divorce. Indiana goes by the “one-pot” theory, which presumes that all property is marital property, whether you acquired such property before, after, or during the marriage. However, this is a presumption at the outset, meaning that all property does not stay in the “marital pot” and may eventually be equitably distributed. If you want to keep certain pieces of property out of the marital pot, you can do so through a premarital agreement. Courts will honor the agreement and uphold anything the parties deem to be separate.

>>For the entire fine print, review Indiana Code Section 31-15-7-4

A $900,000 lesson to all the Hoosiers with a prenup

A recent case from 2020 teaches us a valuable lesson on separate property and prenups. William and Lora Lou were married in 1996. The day before their wedding, they signed a prenup. The prenup declared which assets were to be considered separate property. Remember, separate property means it will not be divided in the divorce. William listed several assets in the prenup which were to remain separate. Among these assets were some retirement accounts with a value of $97,477. The prenup specifically stated that all assets separately owned and in each party’s name at the time of marriage should remain that party’s separate assets and not be subject to division upon divorce.

Fast forward 20 years, and William files for divorce. He files for divorce thinking that his retirement accounts are safe and sound from the property division. Unfortunately, he’s sorely mistaken. His beloved retirement account of $97,477 grew to a whopping $994,523 by 2016. The question became: did the increase in value from $97k to $994k get divided as marital property, or did the increase in value remain separate property, not subject to division?

Drum roll… the ~$900,000 difference was subject to property division because William did not specifically state that the increase in value would also remain his separate property. So, William was able to keep the $97,477, but the court was able to divide up the rest ($897,046) between the two. Some of the judges in this district disagreed with this court’s decision and said it shouldn’t be divided. Regardless of the court’s disagreement, just to be safe, you should always include any increase in value, specifically in the prenup, to avoid the same situation William found himself in.

Thompson v. Wolfram, 162 N.E.3d 498, 506 (Ind. App. 2020), reh’g denied (Feb. 22, 2021)

Spousal Support

Term used for spousal support: “maintenance”

Spousal support, maintenance, and alimony all mean the same thing: financial support ordered by the court to be paid by one spouse to the other. In Indiana, spousal support is referred to as maintenance or spousal maintenance. If you don’t like the idea of paying maintenance to your spouse, you may include provisions in your prenup modifying or eliminating it.

An Indiana court may grant maintenance depending on the circumstances of your case. The Indiana spousal maintenance statute lays out specific scenarios when maintenance may be granted. They are as follows:

- If one spouse is found to be physically or mentally incapacitated

- If one spouse lacks sufficient assets to support themselves

- If one spouse needs support while they acquire sufficient education or training to find a job

Some other factors that the court will consider when deciding if maintenance is appropriate are each spouse’s education level, whether an interruption in the education, training, or employment of the spouse seeking maintenance occurred, and the earning capacity of each spouse.

>>For more fine print on spousal maintenance, read Indiana Code Section 31-15-7-2

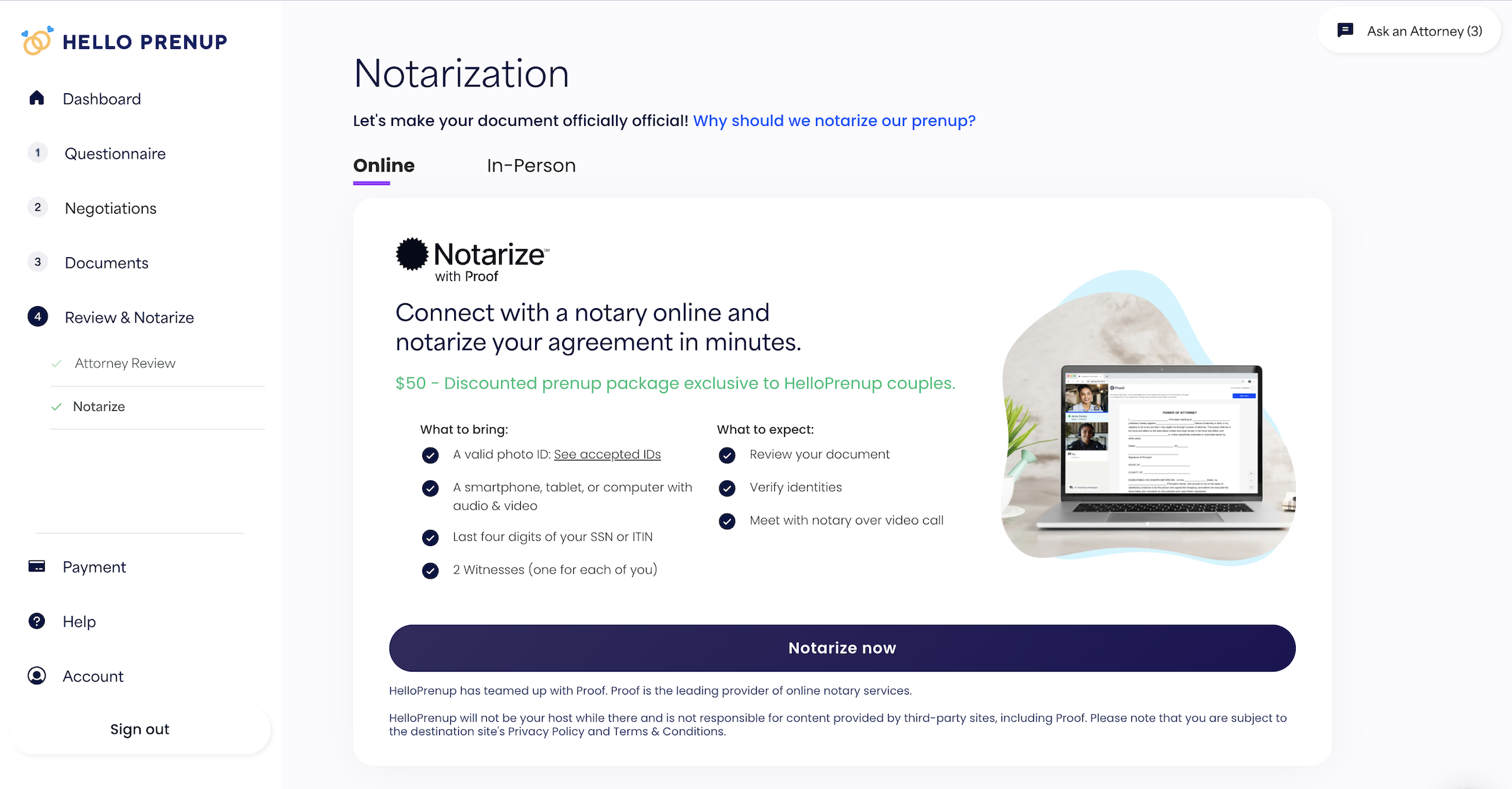

Get your prenup notarized online with our exclusive partnership with Proof (formerly Notarize.com)

Include IN notarization with your prenuptial agreement for just $50:

Now you can create your prenuptial agreement, collaborate on terms with your partner & optional attorneys, then notarize your prenup—all from your couch. The only thing we can’t do? Get married for you.

If you purchase Attorney Representation with your prenup, Notarization is included.

- Finalize your prenup with HelloPrenup

- Connect with Proof (formerly Notarize.com)

- Virtually connect with an online prenup notary

- E-Sign your prenup with notary

- Download & save your notarized document

- Store your notarized prenup securely within your HelloPrenup account

Recent Articles

Self-Care for Couples: Prioritizing Mental Well-being Within Your Relationship

Self-care has become one of those buzzwords that is now met with adamant support or disdain. But no matter your...

Does The Military Recognize Common Law Marriage?

Mike and Brittany lived together on base for a decade. They considered themselves a married couple in every way, but...

When Individual Therapy Isn’t Enough: A Guide to Couples Therapy

If you’re currently in individual therapy, let me start off by saying - good on you! It’s not always easy to recognize...

Ready to start your Indiana Prenup?

Just sign-up, sign-in, and print.

No commitment necessary.

(Not speaking about your marriage – commitment is absolutely necessary there).