It’s surprising, but true: A mere 26% of Americans have an estate plan in place, according to one survey. That means a staggering majority – nearly three-quarters – are leaving themselves vulnerable to a host of potential problems. Think hefty taxes, drawn-out family disputes, and assets ending up in the wrong hands.

But why the reluctance to plan? The survey conductors suggest a link between estate planning and higher wealth, hinting that cost may be a significant barrier for many.

But don’t let cost deter you from securing your future and protecting your loved ones. In this article, we’ll demystify estate planning costs, offer practical tips for making it more affordable, and explain why investing in a plan could be the smartest decision you make. Ready to dive in?

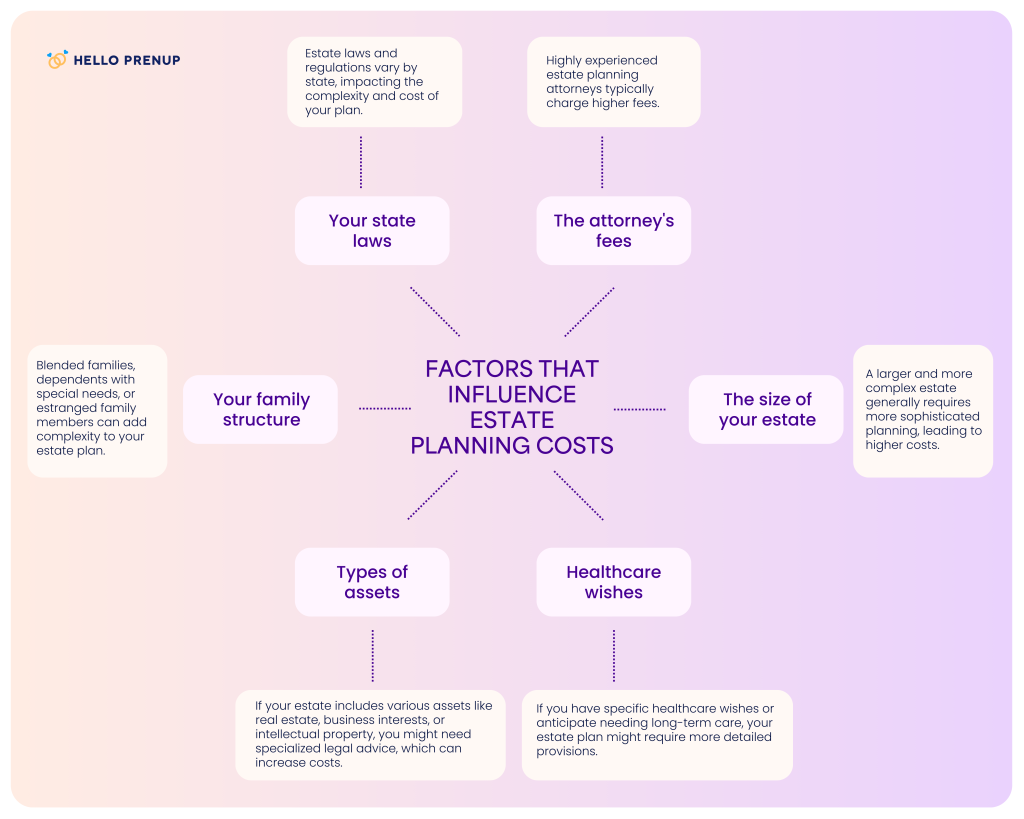

Factors that influence estate planning costs

Let’s first discuss the different factors that influence the costs of estate planning. However, the number one driving cost factor will be the complexity and specific needs of your estate, which will largely determine the final cost. However, here are some key factors to consider:

Typical costs of different estate planning aspects

As you might have guessed, the costs associated with estate planning will be incredibly varied depending on your unique circumstances. What a will costs for one person from one lawyer may cost a completely different amount, even with the same lawyer. However, here’s a general breakdown of the common costs associated with different estate planning tools:

| Will | A basic will generally ranges from $500 to $1,500 depending on your COL area and your needs. |

| Trust | Trusts are more complex than wills and typically start at around $1,000 but can get up to $10,000 or more. |

| Power of Attorney | This document allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. The cost is generally lower than a will and/or trust and may be anywhere from $250 to $1,000. |

| Healthcare Proxy | Also known as a medical power of attorney, this document designates someone to make healthcare decisions for you if you cannot. Costs are similar to a power of attorney. |

| Probate Costs | Probate is the legal process of administering a deceased person’s estate. Wills generally must go through probate and estate without any estate planning documents. Costs vary widely depending on location and the size of the estate. For example, in California, you can expect to pay around $14,000 for a $200,000 estate, according to this probate cost calculator. |

Examples of costs for people

Sometimes, the best way to understand something is to look at examples of people in similar situations. Here are some examples of costs for different estate planning tools in different states.

Example #1: John in California wants a Will

John, 62, wants to get a will to distribute his assets to his kids. He wants to ensure all of his assets go to his kids and wants to include some funeral arrangements as well. He has a small, simple estate. These are generally flat fees, and given the higher cost of living in California, John can expect to pay about $750 for his will.

Example #2: Mary in Alabama wants a revocable trust

Mary, 72, wants to establish a revocable trust to distribute her assets to her children, grandchildren, and third husband. She has a large estate, with businesses, real estate, and other investments. She wants certain assets to be distributed to grandchildren at certain ages and other assets to be divested to her children under certain conditions. Given the lower COL area of Alabama, complex estate, and request for a trust, Mary is looking at a cost of around $2,000-$3,000. Her lawyer will likely charge her hourly

Example #3: Kate wants an advance healthcare directive set up in Illinois

Kate, 32, has major health anxiety and wants to set up an advance healthcare directive (essentially a medical power of attorney), so her mother can make any decisions for her in case of incapacitation. Given that this document is relatively simple and she’s in a mid-level COL area, she can expect to pay around $300 flat for this document.

Tips for reducing estate planning costs

So, how can you cut costs? Here are some tips for minimizing your estate planning costs:

- Shop around for attorneys: Get quotes from multiple estate planning attorneys to compare fees and services.

- Unbundle services: Hire an attorney only to review a will/trust/power of attorney that you’ve already drafted yourself or had drafted online. This cuts down on the attorney’s costs, and you only pay for their time spent reviewing the document.

- Consider online legal services: Online platforms offer more affordable options for basic estate planning documents.

- Start early: Planning your estate early can help you spread out the costs over time.

- DIY simple documents: If you have a smaller, basic estate, with straightforward beneficiaries, you may consider DIYing your will. However, this is not recommended for more complex estates or documents.

- Make sure your documents are organized: If you’re hiring an attorney to plan your estate, you should make sure you come prepared with the correct docs (tax returns, bank statements, etc.). This will cut down on time, ultimately cutting down costs.

Conclusion

While estate planning does involve some costs, it’s a worthwhile investment that provides peace of mind and protects your loved ones. By understanding the factors that influence the costs of estate planning and utilizing tips to reduce the costs, you can create an estate plan that meets your needs and budget.

Nicole Sheehey is the Head of Legal Content at HelloPrenup, and an Illinois licensed attorney. She has a wealth of knowledge and experience when it comes to prenuptial agreements. Nicole has Juris Doctor from John Marshall Law School. She has a deep understanding of the legal and financial implications of prenuptial agreements, and enjoys writing and collaborating with other attorneys on the nuances of the law. Nicole is passionate about helping couples locate the information they need when it comes to prenuptial agreements. You can reach Nicole here: Nicole@Helloprenup.com

0 Comments