What is a prenup?

Here we will answer some popular questions that surround prenuptial agreements (otherwise known as a ‘Prenup’ or ‘premarital agreement’):

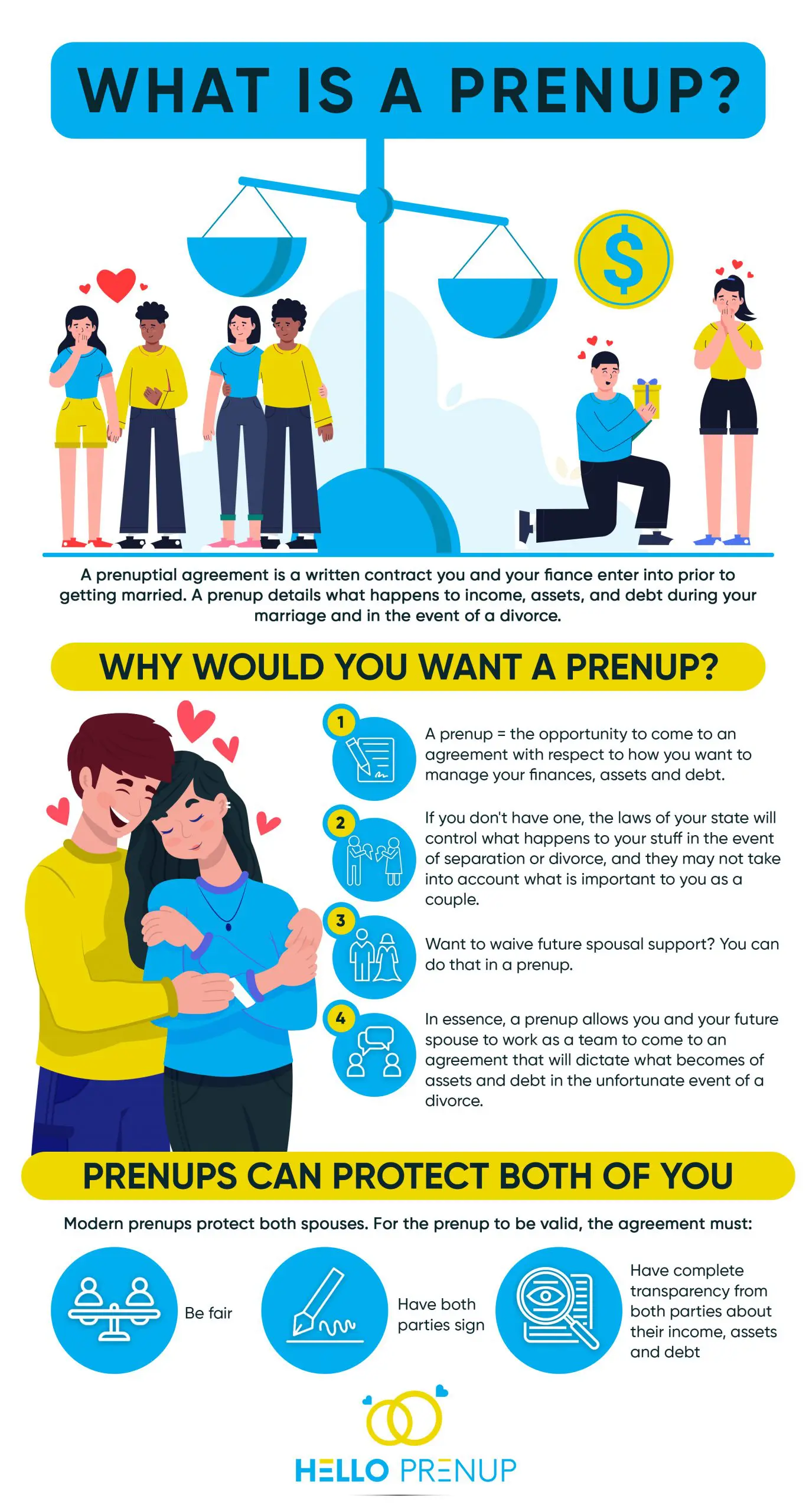

What exactly is a prenup?

A prenup (a.k.a., a prenuptial or premarital agreement) is a contract between two people who are about to get married. The contract must be signed before the wedding day, otherwise it is not valid. This contract lists all the terms you agree to abide by in the event of a divorce (and sometimes death) and details the assets that you hold as a couple or individually.

You can use a prenup as a sort of financial planning tool, allowing you and your future spouse to discuss how assets and debt will be managed during the marriage, too. The terms of a prenup can determine assets, debt, alimony (a.k.a., spousal support), inheritances, gifts, taxes, joint bank accounts, pet custody, and much more.

The history of a prenup and its purpose

The very first prenups date back to ancient Egypt! Back then, prenups were verbal or written contracts establishing the property that each spouse would bring to the marriage. In addition, ancient prenups were used to establish the bride’s dowry; namely, the price that a groom would pay the bride’s family in exchange for marrying her (ugh).

Today, couples enter into prenups to override the default divorce laws that govern marital property division and spousal support. Each state has its own divorce laws, and these default rules govern the way courts will divide property in the event of a divorce, including bank accounts, investments, and more.

Prenups allow couples to override default state law in a divorce, which allows couples to decide what property division should look like based on what feels right for them.

Real Life Examples

Real Life Examples

Keeping Assets Separate

Kelly and Josh are in their mid 30’s, and are engaged to be married. Kelly purchased a condo a year before she met Josh, and since she and Josh have been dating, he moved in and now pays her rent. They also share the other expenses associated, like utilities, etc. Kelly wants to make sure that even after they are married, her condo remains her property alone. Afterall, she purchased it with her own money. Kelly wants to protect both her initial investment (the downpayment), as well as any appreciation in value on the condo during their marriage, even while Josh is living there or if the condo is their primary marital residence. After all, this condo was her investment which she worked hard for and materialized on her own!

In their prenup, Kelly can list the condo as her separate property, and specify that the condo, including any appreciation on the property during their marriage, should remain hers and hers alone. If the condo is sold in the future, the proceeds will be Kelly’s separate property. If the proceeds from the sale get rolled into a joint marital home that Kelly and Josh buy together, the prenup can specify that the funds from the sale of her condo should remain her separate property, and not become marital (or community) property.

Why does this matter? Depending on what state the couple lives in and the length of marriage, the condo that Kelly bought could become marital property and subject to division in a divorce. A prenup allows the couple to prevent this from happening by agreeing that an asset, like Kelly’s condo, along with any appreciation and the associated mortgage, remain Kelly’s separate property as well as separate debt.

Student Debt

Plot twist! Kelly has $200,000 in student debt from her undergraduate and graduate degrees. She plans to enroll in a PHD program at some point in the next couple of years, and will likely need to take out more student loans. Josh, on the other hand, has no student debt. Kelly and Josh can specify in their prenup that any debt, including Kelly’s premarital student debt as well as any school debt she accrues in the future, should remain her debt alone and not be considered joint marital debt at any time.

Why does this matter? In a divorce, judges in many states have immense discretion as to how debt should be distributed among the parties. In certain situations, a judge could choose to attribute some of one spouse’s debt to the other, especially in the case where the other party directly benefited from the result of that debt.

Financial Gifts

Kelly’s parents regularly give her monetary gifts, and they plan to continue doing so after Kelly and Josh are married. Josh is pumped because he is really sick of working and these monetary gifts mean he could cut back on work, vacation more, or even pursue his hobby of becoming a surf instructor. Kelly thinks those monetary gifts should be considered her separate property and invested in her separate investment account. She does not believe those gifts should be considered marital or community property, because they come from her parents. By having a prenup, Kelly and Josh will have the right to decide together exactly how monetary gifts should be classified in their marriage, and are free to choose whether those monetary gifts should remain Kelly’s separate property or become marital or community property that is shared by the couple.

Why does this matter? Without a prenuptial agreement, in most states, monetary gifts received during marriage will be considered marital, or community property. A prenup allows couples to decide if they would like those monetary gifts to be considered separate property.

Inheritance

Kelly’s parents plan to pass down a significant inheritance to her in the future. While they are excited to welcome Josh into their family, they do ask Kelly and Josh to consider a prenuptial agreement to protect any inheritance they pass down to her in the future. Kelly and Josh agree that any inheritance from either of their parents should be considered the property of the spouse from whose family the inheritance comes. The categorization of inheritance as separate property can be written into a prenuptial agreement. This is becoming more common as an unprecedented generational wealth transfer is beginning to occur between baby boomers and their millennial children. It is common for parents to request that their children obtain a prenup prior to marriage in order to protect family businesses, wealth, or other family assets.

Why does this matter? Without a prenuptial agreement, inheritance may or may not be considered marital property. In certain states, inheritance is automatically excluded from the marital estate. In other states, if it was received during the marriage, it is automatically considered marital property. Many parents who are considering passing down their wealth to their children, either in trusts or through other mechanisms, are concerned about the prospect of their hard-earned wealth being split during a divorce.

The business Owner

Larry is a w-2 employee and conservative with finances. Jerry, his fiance, is an entrepreneur and much more of a risk taker. Jerry’s decision to start a business may prove more risky, but may also pay off handsomely. Larry and Jerry can stipulate in their prenup that any debt Jerry incurs as a result of starting or running his business should be solely his. In addition, they can agree that all income or equity derived from that business should be solely his as well.

Why does this matter? Without a prenuptial agreement, Larry may be responsible for some of Jerry’s business debt, as well as entitled to some of Jerry’s business. The most extreme and perhaps more complex divorce cases arise when one spouse is a business owner and the judge deems the other spouse entitled to some of that equity or to the value of half of the business-owner spouse’s equity. In this case, the parties will likely end up in very expensive divorce litigation, involving business valuation experts, inquiry into the operations of the business, and possibly even a trial. A prenup can help avoid all of that by allowing couples to decide together whether they want that business to be considered separate property, or whether it should be considered marital.

Note: This is not intended to be an exhaustive list of all scenarios, but rather is intended to offer one example of how a prenuptial agreement may be helpful. These examples are purely informational and is not legal advice. If you would like to obtain legal advice regarding your individual situation, you should contact an attorney in your state.

Is a prenup good or bad?

Well, you know how we are going to answer this… prenups are good!

Some people believe that this answer depends on what side of the prenup you find yourself. However, we disagree– prenups are helpful for most couples, and in fact, can also protect the less wealthy party.

Overall, prenups can help protect your financial and business interests should the worst-case scenario happen. (Almost) more importantly, prenups also help couples come to an agreement on how to save or spend money during their marriage, an understanding of how assets will be held, how inheritance will be considered (marital or separate property?), and whether spousal support is something that should be considered in the event of a divorce.

Who benefits from a prenup?

Both of you!!!

Generally, prenups are a good idea for anyone with earning potential, assets, debt or potential future inheritance.

Do you own a business or are you a partner in a business? Get a prenup!

Are you entering into a second marriage? You should seriously consider one.

Prenuptial agreements are an extremely useful way to take care of financial planning matters when children from a prior relationship are in the picture. Let’s put it this way – while not every couple needs one, almost every couple will benefit from a prenup, because they encourage mutual problem-solving and financial planning that will ultimately equip a couple to decide on what is important to them in a relationship.

Do prenups cost both spouses money?

They can – but most couples agree that they will each pay for themselves.

The cost of a prenuptial agreement depends on many factors that can include your location, the complexity of your assets, as well as what clauses you want to include.

Per person, attorney-drafted prenups tend to range in the $1,200 to $2,400 bracket. Typical retainers are around $2,500 each (if things are uncomplicated), whereas more complex assets or negotiations can bring costs up to $7,500 to $10,000 each. Remember, lawyers charge by the hour, and many charge in 6-minute increments. The cost adds up quickly. Some factors in pricing include where you live, the complexity, the experience or reputation of the lawyer drafting the agreement (which affects their fees), and your assets.

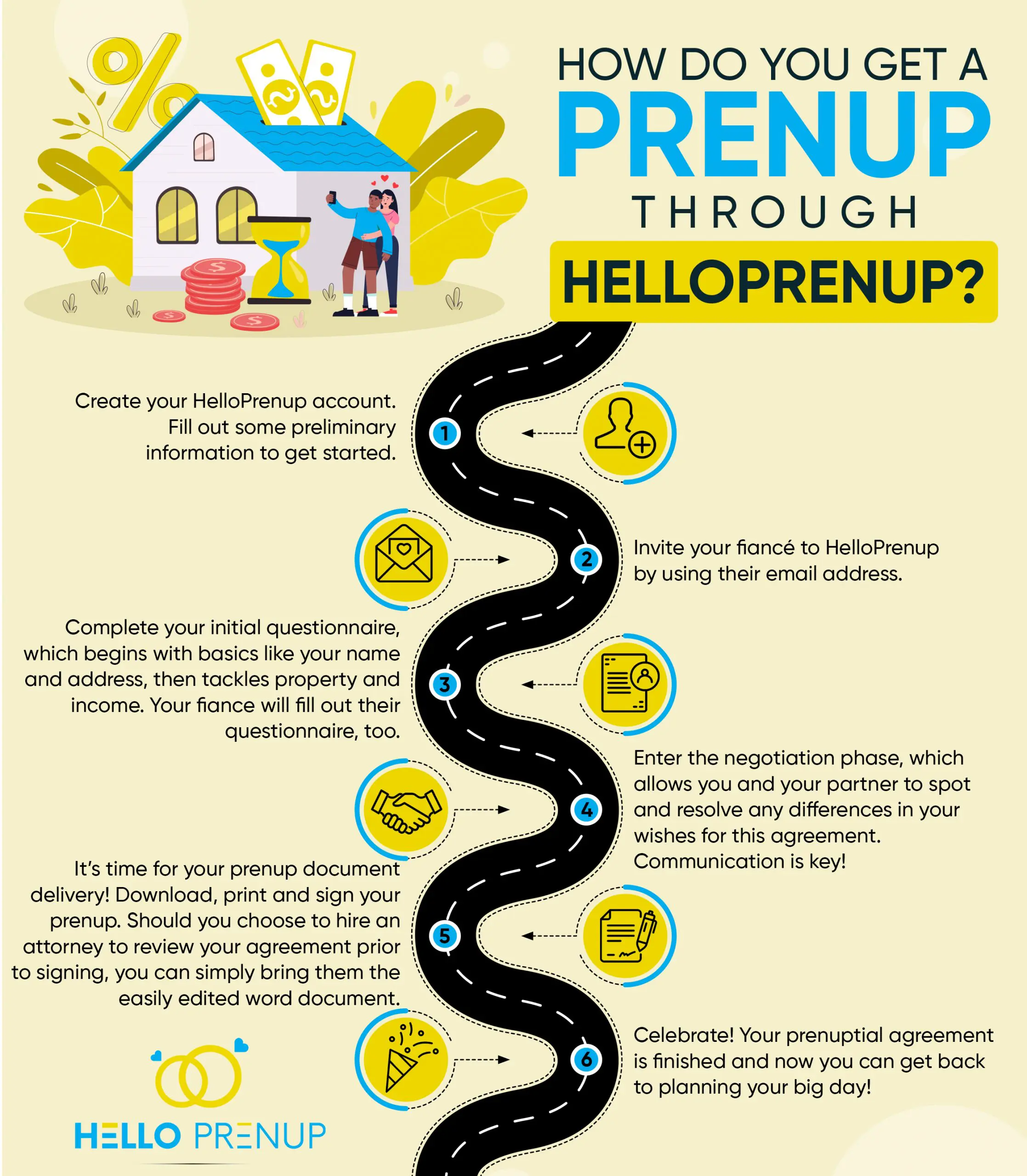

HelloPrenup combines technology and law to allow couples to create their prenup agreement in hours instead of months, and for a fraction of the cost of the traditional approach, like using two attorneys. Instead, utilizing our platform, couples can create and negotiate their prenup as a team. And, if you want legal advice? You can take your draft to an attorney!

What should you ask for in a prenup?

Keeping in mind the bespoke nature of a prenup, one size does not fit all. However, there are some pretty standard considerations you should seek to address. These may include:

Property (Premarital)

The property you bring into your marriage and want to remain yours and yours alone is considered pre-marital property. If you bought a home before the marriage and you want that home to remain yours, safeguard it with a prenup. Classify it as your premarital property!

Infidelity Clause

Infidelity clauses are becoming more and more popular these days, but beware- they are not always enforceable. Many infidelity clauses impose a financial penalty for cheating. Although these clauses are not always enforced by courts, sometimes that is not the point. Instead, a cheating clause will act as an emotional understanding between the couple, ensuring they are on the same page.

Gifts

Spouses may receive certain gifts from family members during their marriage, ranging from cash to a car to jewelry. Prenups can group all gifts belonging to one of the parties and classify those gifts as separate property and not subject to division in the future.

Alimony

Sometimes called spousal support, this is the legal obligation to provide financial support upon marital separation or divorce. Now, one could make the argument that alimony has been technically gender-neutral since the early 1970s, and therefore men, too, could be greatly affected by an alimony clause in a prenup. But the reality persists that 97% of alimony recipients are women. So, again you ask, how does alimony relate to a prenup? And… isn’t a prenup generally bad for the lower-earning spouse? That may be the perception, but we are here to tell you, that is not accurate. A prenuptial agreement allows couples to contract around their state’s divorce laws and come up with an agreement that is right for them. This means that although, yes, a prenuptial agreement can deprive a party of rights that they would otherwise receive under the state law had they not entered into a prenuptial agreement, like a waiver of alimony clause, it also means the opposite.

Want to create your own financial arrangement, that perhaps is more advantageous than the typical alimony calculation? You can do that in a prenup!

Understanding Alimony / Spousal Support

What is Alimony / Spousal Support?

Alimony (also known as spousal support) is financial support provided by one spouse to another upon divorce. The whole point of alimony is to help maintain the lifestyle established during the marriage and to ensure that one spouse is not left in a financially disparate position.

Let’s take the historical example of the “homemaker” and the “breadwinner”. The homemaker left their career in order to support the family at home while the breadwinner provides the financial support. Twenty years later, the couple divorce. At that point, the homemaker has been out of the workforce for a long time and will likely find it difficult or even impossible to reignite their career. So, to help maintain the financial status quo, a court would likely require the breadwinner to pay the homemaker alimony in order to help maintain the marital lifestyle.

Now, this is a very simplified example. There are different types and durations of alimony. These also vary by state. Also, the situation is seldom so black and white.

Types of Alimony

Types of alimony vary by state. However, there are a few alimony categories that are prevalent in many states including temporary, rehabilitative, and permanent alimony. To start, the category of alimony that you are entitled to is typically determined by the length of the marriage. So, if you were married for 72 days a la’ Kim K and Chris Humphries, alimony likely wouldn’t come into play. Why? Well, 72 days isn’t exactly enough time to become accustomed to a marital lifestyle that alimony is intended to maintain. However, the length of the marriage isn’t the only consideration and even after a short marriage, a spouse may be entitled to alimony. Now, let’s talk about a few of the big categories of alimony/spousal support.

Temporary Alimony (or Pendente lite)

As the name suggests, this type of alimony has a shelf life. In fact, in many states, temporary alimony is only intended to last during the divorce process. Once the divorce is finalized, that’s it. This is intended to help the less wealthy spouse during the transitional time, especially if there is only one income between the two spouses. A majority of states, including Florida and California, have versions of temporary alimony (called pendente lite in California – meaning “during litigation”).

Rehabilitative Alimony

This type of alimony is intended to help the less wealthy spouse get back on their feet following divorce. Perhaps this spouse has been out of the workforce for a while, but not so long that returning would be impossible. Enter rehabilitative alimony! Now, generally, in order to be entitled to rehabilitative alimony, the marriage itself has to have hindered your earning potential. The classic example is a spouse foregoing their career to stay home and care for the couple’s children. The presumption is that after getting back on their feet, the lifestyle of the spouse that received rehabilitative alimony will be similar to that of the marital lifestyle.

Permanent Alimony

Permanent alimony is intended to provide financial support to a spouse that, generally speaking, will be unable to become self-sufficient after divorce. Despite the name, permanent doesn’t necessarily mean forever. In fact, many states have placed concrete limits on this type of alimony. For example, in Texas, even if a couple has been married for more than 30 years, there is a 10-year cap on alimony. In fact, more and more states are moving away from lifelong alimony.

*Get out of jail free card* – here’s some good news. In most states, if your spouse remarries, you are freed of your alimony obligations.

Prenup Considerations

So, now that we’ve learned a little bit about the different types of alimony and their durations, what does this mean for your prenup?

Well, good news! With a prenup, you and your spouse have (almost) total control over alimony. Want to chuck it all together? Go for it? Want to set the amount? Have at it! Want to set caps? You can do that too! It’s almost free game as to how you, as a couple, would like to handle alimony.

However, there are some important (state-dependent) caveats. In certain states, the court will not enforce an alimony waiver if it will leave a spouse destitute. Additionally, the alimony provisions in your prenup will be factored into the analysis when the enforceability of a prenup is challenged. For example, perhaps one spouse will argue that there are changes of circumstance which make the enforcement of a total alimony waiver unconscionable (check out more on this here). These are factors to consider when determining what alimony arrangement you and your spouse are comfortable with.

- Does cheating void a prenup?

- Does a prenup protect future earnings?

- Should I be offended by a prenup?

- How long before a wedding should you get a prenup?

- Are prenups a good idea?

- How do you avoid a prenup?

- Can a prenup be 'broken'?

- Are marriages with prenups more likely to fail?

Adultery or abuse does not invalidate a prenuptial agreement unless the agreement specifically states so. While you can include an infidelity clause, they are not always enforceable.

Notably, in the court case of Diosdado v. Diosdado (2002) a Californian trial court found that an infidelity clause was not enforceable because it was contrary to the public policy underlying California’s no-fault divorce laws. However, these clauses are still often requested and included.

This is possible but is less straightforward than some other provisions. Prenups can protect future earnings if those earnings are explicitly set out as separate property in the agreement, and not commingled as marital property during the marriage.

No! Of course not. Many people believe that it is unromantic to talk about money. Others believe a prenup disincentives couples from taking marriage seriously. We disagree.

Honesty and open communication is the bedrock of a healthy and happy relationship, and in achieving this level of transparency, you need to discuss financial matters with each other. You should not be offended if the idea of a prenup is brought up. Sensible and emotionally mature couples must consider the realities of divorce and the fact that the longest marriages require consistent communication around money.

The process for getting your prenup should ideally be started (at least) three months in advance of your wedding. Why? You don’t want to spring the idea of a prenup on your fiancé last-minute… that’s just rude! Many people do not get around to having THE convo or starting the process and leave it until too close to the wedding, which leads to a lot of stress. Don’t wait until the last minute!

Prenups follow an adult conversation that is open, honest, and emotionally mature. There are rational reasons why you may want a prenuptial agreement. A common belief is that a prenup is much like an insurance policy. The prenup is essentially insurance and like any insurance policy, you should always be covered as you never know what may happen.

Here are some reasons why having a signed prenuptial agreement is a good idea:

- The ability to make decisions yourselves rather than having a judge or state law decide for you.

- Protection from the other’s debt.

- Collaborating on terms together, like the team that you are!

- Lower cost of divorce in the future.

- Established plan for spousal support.

- Jointly deciding on a property division arrangement.

- Understanding of how property is owned – whether it is separate or marital property.

- Understanding of what happens to inheritance, if either of you is to receive an inheritance.

So, to answer the question; yes, prenups are a good idea and a wise investment. It takes the power away from outside parties in making decisions for your life that you may not agree with. If drafted fairly and properly, both parties win.

You can simply not have one drafted and take your chances. One alternative that people often think of is a ‘trust’. A legal trust is a structure to hold the individual’s property subject to certain duties for the benefit of others. Trusts may be used to protect inheritance or family assets and they offer asset protection in the event of divorce; namely, the money or property has been placed in trust. However, trusts are complex matters, and in many states, the fact that you are a beneficiary of a trust can be brought into divorce proceedings. We are not saying to not create a trust, but what we are saying is that don’t forfeit a prenup for a trust with the misconception that a trust is easier or more reliable.

Prenups and trusts are two very different things. Today you can create a trust or will online.

Any contract can be invalidated if certain requirements are present or not present. For example, if a prenup was signed under duress then it cannot be enforced. What is duress? The most dramatic (but clear!) example is putting a gun to someone’s head and saying “sign on the dotted line!” Certainly, that person did not sign that contract voluntarily- they had a gun to their head! But, the conditions don’t have to be that egregious to invalidate a contract – especially when you are dealing with prenups. Other issues that can invalidate a prenup include missing signatures on the document, or most commonly in the land of prenups, inadequate or incomplete financial disclosure. So, how do you know what the general guidelines are? Well, this can get confusing- each state has its own guidelines. 28 states now subscribe to the Uniform Prenuptial Agreement Act (UPAA) and have adopted it as a general guideline to govern the enforceability of prenup agreements in those states.

NO! In fact, quite the opposite. One interesting statistic is 64% of divorce attorneys say that they have seen an increase in prenuptial agreements in the last four years. Also, 46% of divorce attorneys noted they’ve noticed a dramatic increase in the number of women who have initiated the requests for a prenup. Given that approximately 50% of marriages end in divorce, it seems like people are becoming more realistic about the idea of a prenup.

What are (some of) the pros of a prenuptial agreement?

01. Allows you the opportunity to discuss your dreams, desires, and goals for your marriage.

A prenup cannot govern how often (or how little…) you are required to see your in-laws each year, but having that conversation can certainly be a part of this discussion, among many others while talking about your prenup. You can cover non-financial lifestyle details by way of talking about whether or not alimony should be waived. Like, does one of you plan to stay home and raise the children? If one of you does leave their career for a few years, what happens financially to that spouse’s interest in the assets or alimony? This is really important to think about and gets into the gender wealth gap conversation.

02. Spousal Support and Alimony

You can limit or waive the amount of spousal support that would otherwise be required if you did not have a prenup. State laws or guidelines, which vary greatly, dictate the factors to be considered and the calculation of alimony or spousal support. In a prenup, you have the power to decide whether or not alimony will be paid!

03. Protect your business.

A prenuptial agreement allows you to protect your business from being subject to the involvement or control of the other spouse in a divorce. Ask Jeff Bezos who has learned this the hard way

04. Make sure you are on the same page.

As we love to say, “you are starting your life together… make sure you are on the same page.” A prenuptial agreement allows you to decide what assets are premarital, what should be marital assets, and what should happen to inheritance. Should it be marital, or remain separate? You decide. These conversations are essential to a healthy, happy, and long marriage.

05. Second marriages will greatly benefit from a prenup

Prenups protect the financial interests of individuals in a marriage, and this can be especially true when they get married older, or as a second marriage. A prenup for a second marriage provides a layer of protection by allowing couples to ensure their premarital assets that should be reserved for the benefit of their separate children, do not become marital or community property. Check out our article on a Second Marriage survivor’s story and why you need a prenup.

06. Can you really put a price on peace of mind?

Maybe. How does $599 sound? #KiddingNotKidding. The average prenup will cost about $2,500 per person if you hire an attorney to negotiate and draft your agreement. HelloPrenup offers a prenuptial agreement at $599. And, if you want to hire an attorney to assist with that draft? Easy peasy! Just send them the easily downloaded Word doc.

What could a prenup include?

Well first, you both need to fill out a financial schedule, disclosing your finances, including assets and debts. Then, you will have the option of considering the following to include…

Marital vs Separate property.

A prenup allows you to decide what you want to be considered separate property vs what you want to consider marital property. Separate property often includes assets spouses owned before getting married or assets that were gifted or inherited. In general, a prenup can determine how marital property is divided and how separate property is treated.

Protections against the debts of the other spouse.

Without a valid prenup, you could be liable for your spouse’s debt. This is a hot-button topic for couples marrying who have student debt (doesn’t almost everyone?) Limiting your debt liability, instead of having each spouse owe half of everything, including the debt, can substantially limit the stress on a relationship.

Ensure that your children are provided for if you are entering into a second marriage

Those children from any previous relationships will certainly be a big part of your new family, so make sure to plan for how assets that are intended to remain with those children should be held (ie. separate property).

Pets.

If you share a pet or pets, then it’s worth thinking about what will happen to them as you draw up your prenuptial agreement. In the event of a divorce, will one of you keep your pet? Will it depend on your living situation or income at the time of separation? This issue can become remarkably fraught and is often overlooked.

Waivers of alimony.

Usually, the lower-earning spouse is entitled to alimony from the higher-earning spouse. Alimony and spousal support are calculated depending on state law.

Sunset clause.

A sunset clause is a creative way for your prenup to expire at a certain date and can ease the tension when discussing the provisions of a prenup.

What is not included in the prenup?

There are things that you cannot include in a prenup:

Incentives.

Prenuptial agreements cannot encourage divorce, such as giving a spouse a monetary incentive to get divorced.

Child custody.

This may not be included in your prenup because the rights of children cannot be contracted away in a prenuptial agreement.

Child support.

Child support is dictated by state laws or guidelines that provide for a specific calculation. Each state is different. Any provision that attempts to control or limit the amount of child support will not be valid.

Tasks.

Provisions that delegate daily tasks or spousal duties that are not financial in nature may not be included. So, no, you cannot include provisions that require your spouse to have sexual relations with you a certain number of times a week or require that they remain under a certain weight. Celebrity lifestyle clauses are synonymous with these provisions, but we wouldn’t recommend including them as they will not be enforced!

Provisions.

Provisions that deprive a spouse of all assets and income, and therefore render them dependent on public assistance after a divorce are against public policy and not enforced.

Articles on Prenups

What Are The 7 Principles For Making Marriage Work? Insights From a Psychologist

What makes a marriage work? Everyone has their opinions and thoughts, and there are many different modalities in...

Understanding When Family Law And Estate Planning Intersect: A Look At Prenups, Living Trusts, And Wills For Wealth Management

Welcome to the exciting world of personal finance and estate planning! Legal documents are vital tools for protecting...

How To Protect My Property Without A Prenup

If, for whatever reason, you don’t want a prenup or cannot get one (maybe your future spouse is refusing one), you may...