Kentucky Prenuptial Agreement

Taking the plunge in the Bluegrass state? (For those of you who don’t know, that’s Kentucky.) No matter your financial situation, a prenup is something all Kentuckians (and non-Kentuckians) can benefit from! Get out the fried chicken and buckle up for some helpful tips on prenups in Kentucky.

Here’s some information you need to know about Kentucky prenups, the legal jargon that is used, and the terminology you’ll want to know.

Kentucky Prenuptial Agreements

A prenuptial agreement is a legal contract drafted between two spouses before marriage. It is only valid after the marriage takes place. In Kentucky, case law outlines the rules and requirements for a valid agreement. A Kentucky prenuptial agreement may include alimony modifications, property division, insurance policies, and more. On the other hand, a prenuptial agreement in Kentucky cannot limit or contract around child support, child custody, matters violating public policy, or grossly unequal terms (a.k.a., unconscionable terms).

How to create a KY Prenup

The contract must be in writing

The terms must be lawful

The terms must be conscionable

Signatures from both parties (HelloPrenup recommends initialing each page, and having your signatures notarized!)

Signed voluntarily (without being under duress, intimidation, deceit, etc.)

Notarized signatures (no, you should not skip this step!)

Full disclosure of all financial assets and income *Do not skimp on this*

Must be executed voluntarily without fraud, duress, or mistake

Must not include child custody or child support

No incentives to commit illegal acts

No terms violating public policy

No unfair, unjust, or deceptive terms

Must not include terms that are not financial in nature, like demanding that one spouse loses weight or changes appearance

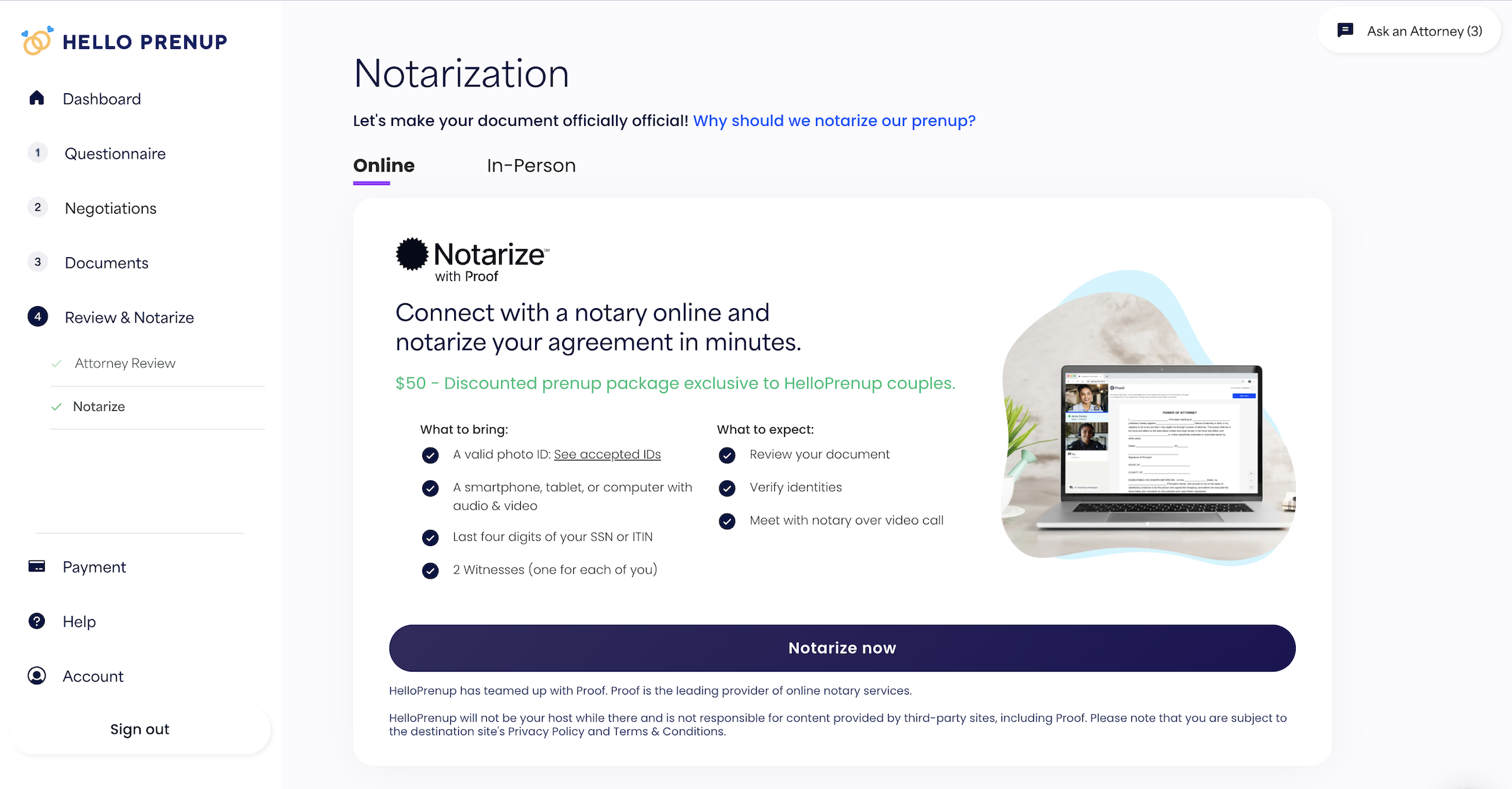

Get your prenup notarized online with our exclusive partnership with Proof (formerly Notarize.com)

Include KY notarization with your prenuptial agreement for just $50:

Now you can create your prenuptial agreement, collaborate on terms with your partner & optional attorneys, then notarize your prenup—all from your couch. The only thing we can’t do? Get married for you.

If you purchase Attorney Representation with your prenup, Notarization is included.

- Finalize your prenup with HelloPrenup

- Connect with Proof (formerly Notarize.com)

- Virtually connect with an online prenup notary

- E-Sign your prenup with notary

- Download & save your notarized document

- Store your notarized prenup securely within your HelloPrenup account

Caselaw & Your KY Prenup

We can learn a lot from caselaw.

Here is the case that made it possible for you to get a prenup in KY. Take the case of Mr. and Mrs. Edwardson, who filed for divorce in 1990. Mrs. Edwardson sought enforcement of the prenup. At first, the lower courts declined Mrs. Edwardson’s request because prenuptial agreements weren’t allowed in Kentucky at the time. It was thought that prenups promoted marital instability and were detrimental to women… (read on, below)

A Couple of Important Divorce Cases Relating To KY Prenups

Landmark case allowing the use of prenups in Kentucky

The 1990 landmark case allowing the use of prenuptial agreements in Kentucky

Mr. and Mrs. Edwardson entered into a prenuptial agreement that provided for maintenance payments of $75 per month if they got divorced. The spouses filed for divorced, and Mrs. Edwardson sought enforcement of the prenup. At first, the lower courts declined Mrs. Edwardson’s request because prenuptial agreements weren’t allowed in Kentucky at the time. Mrs. Edwardson brought this issue all the way up to the Supreme Court of Kentucky. There, the judges agreed with Mrs. Edwardson and overturned the long-standing law holding prenups invalid. The previous decisions of the Kentucky court declared prenups void as violating public policy. It was thought that prenups promoted marital instability and were detrimental to women.

The judges in the Edwardson case had some big changes to make that day. They declared that in today’s day and age, prenups no longer promote marital instability and that women no longer needed “protecting” from prenups. The court further clarified that if there has been full financial disclosure, there is no unconscionability surrounding the agreement, and it was not obtained under fraud, duress, or mistake, then it should be validated. That’s a win for modern marriages!

Edwardson v. Edwardson, 798 S.W.2d 941 (1990)

John and Erin signed a prenuptial agreement, to Erin’s disapproval. John presented the prenup to Erin just days before the wedding. Erin vehemently disagreed to it at first. Then, after John told her he would not get married without her signing it, Erin agreed to discuss it. John’s attorneys referred Erin to a recent law school graduate who had never negotiated a prenuptial agreement. This attorney “represented” Erin and negotiated 1/6th of John’s estate in the prenup. He was also not able to verify John’s financial disclosure provided and decided that this was okay because it would probably be in Erin’s favor anyway.

Erin was sobbing uncontrollably during the negotiation meeting because she did not want to do this. She felt backed into a corner because 200 guests were already on the way, including her parents, who flew in from Thailand.

When John died, Kathryn, John’s first wife, sought to enforce the prenup, while Erin sought to throw it out because she did not sign it voluntarily. The court agreed with Erin and declared the prenup invalid based on duress. The court explained that if an agreement was signed under duress, it was not signed voluntarily. The circumstances were coercive, one party exerted wrongful pressure, and the person had no other alternative but to sign the agreement. The court also noted that timing is a huge factor; the prenup should be presented at least 30 days before the wedding.

In this case, the court said that Erin did not sign voluntarily based on several reasons:

- If she refused to sign the prenup, she would have to cancel a 200-person wedding and lose her means of support (i.e., John). He had encouraged her to quit her job so he could support her.

- John contemplated the prenuptial agreement two years before the wedding, yet he only presented it to her a few days before it. This left Erin with very little time to obtain her own attorney and negotiate the contract.

- Erin’s so-called attorney was not an adequate representative, he had no experience in negotiating contracts, and he never verified John’s financials.

The court said Erin did not sign this prenup voluntarily with all of these things considered.

In re Est. of Hollett, 834 A.2d 348 (N.H. 2003)

Higher net worth than when you signed your prenup?

What if you end up divorcing with a much higher net worth than when you signed the prenup?

An important case from 2001 arose out of a Kentucky Court of Appeals. Husband and Wife were married twice, with a prenup preceding the second marriage. At the time of the second marriage, Husband’s net worth was around $5 million, and Wife’s was $190,000. They finally settled on a prenup which provided that each spouse’s separate property would remain separate in the event of a divorce, and Wife will receive a car, furniture, certain personal items, and cash in an amount reflecting the length of the marriage (which in this case came out to be $650,000).

At the time of the (second) divorce, Husband asked the court to enforce the prenup. Wife argued it was unconscionable because the circumstances had changed so drastically. Husband’s net worth dramatically increased since they signed the prenup. Husband’s net worth grew to around $24 million. She argued it was grossly unfair and thus, unenforceable.

In Kentucky, there is a three-prong test (known as the “Gentry test”) courts use to determine the enforceability of a prenup: (1) Was the prenup obtained through fraud, duress, or mistake? (2) Is the agreement unconscionable? (3) Have the circumstances changed so as to make the agreement unreasonable? Here, Wife is arguing prong #3, that Husband’s net worth has grown so much that it renders the agreement unreasonable. There’s no bright line for determining which circumstances are unreasonable, judges must decide it on a case-by-case basis.

In this case, the court sided with Husband and declared that increasing one’s net worth is not the type of change in circumstances that renders a prenup unreasonable. In other words, just because Husband’s monetary value increased drastically does not mean the prenup should now be considered unfair. Wife decided to sign a contract, and just because he has more money now doesn’t mean the contract can be thrown out. The court further explained that to throw out this prenup, Wife would have had to show that not only did Husband’s financials drastically improve but that her financials drastically got worse. That is not the case; her situation did not get worse.

What’s the lesson learned here? You should know what you’re getting yourself into when you sign a contract, especially a prenup; and if you don’t, you should get a lawyer! When you waive your right to certain property or finances, you will be held that standard and a court will not help you out just because you made a poor contract choice. When you were a kid, there were no “takebacks” on a pinky promise. Same goes for prenups.

Blue v. Blue, 60 S.W. 3d 585 (Ky. App. 2001)

First comes disclosure, then comes the signature!

Here is a cautionary tale of the pitfalls that you may encounter if you do not disclose your financials in a prenup. In 2012, Husband (a doctor) and Wife (a nurse) met, fell in love, and began planning their wedding. This was both their second marriage.

Shortly before their wedding, they prepared a prenup which stated he was required to pay her the equivalent of her salary and double that amount if he were unfaithful. In the event of his death, she would receive $200,000 and her own, separate property. The prenup also contained a clause stating that the spouses acknowledged they had made full disclosure of the nature, extent, and value of each spouse’s separate estate and financial condition as of the date of the agreement. In reality, neither spouse sent over financial statements to the other, nor were there any statements attached to the prenup itself (red flag!).

Husband ended up dying four years later. At the time of his death, his net worth was $5.2 million. Wife sought to invalidate the prenup because neither of them provided financial disclosures when executing the prenup. She testified that she was not aware of his full financial situation. Under Kentucky statutory law, Wife would most likely receive more money than she contracted in the prenup. Husband’s children from his previous marriage sought the opposite: to enforce the prenup so Wife would get less money from his estate.

In assessing the validity of a prenup, the court must ask: “Was there a full and complete disclosure of the financials by each spouse at the time the prenup was entered into?” In this case, the answer is “no.” Even though the prenup contained a clause stating that each party had full knowledge of the other’s financial situation, Wife’s testimony was enough evidence to show that she did not know his financials. The court ultimately agreed with Wife and declared the prenup void because the parties did not adequately provide financial disclosure.

What can you learn from this case? Always. Disclose. Your. Financials. And. Attach. Them. To. Your. Prenuptial. Agreement.

King v. King, 638 S.W. 3d 464 (Ky. App. 2021)

What’s mine is mine and what’s yours is… ours?

Separate Property

Separate Property

Official term for property not considered part of the marital estate in Kentucky: Marital property

Property is either considered non-marital property or marital property. Marital property is split up in the divorce; non-marital property is not. Generally, non-marital property in Kentucky is property acquired before the marriage, gifted or inherited by one spouse during the marriage, or sale of non-marital property. On the other hand, marital property is property acquired during the marriage. For example, let’s say you purchase a car for yourself while you are married; this will be considered marital property and may be “divided” in the divorce. If this framework is not to your liking, you should specify it clearly in a legal document, such as a prenuptial agreement. You can clearly delineate in a prenup which property should be considered non-marital, and the court should follow your requests.

>>For more fine print on property division in Kentucky, read KY Rev Stat § 403.190

Marital Property

This is the KY term that is used to describe any income or property (real or personal) that is considered subject to division upon a divorce.

Maintenance (aka Alimony)

Official term for spousal support in Kentucky: Maintenance

In Kentucky, alimony is often referred to as “maintenance,” the financial support ordered by a court to pay one spouse to the other. A Kentucky judge may find spousal maintenance appropriate when the needing spouse lacks sufficient funds to support themselves, and the needing spouse is unable to become self-supporting. Both must be true to require maintenance to be ordered.

Kentucky’s goal in providing spousal maintenance is to close the gap between the means of both spouses. If this framework is not to your liking, you should specify it clearly in a legal document, such as a prenuptial agreement.

>>For more fine print on maintenance in Kentucky, read KY Rev Stat § 403.200

Recent Articles

What Are The 7 Principles For Making Marriage Work? Insights From a Psychologist

What makes a marriage work? Everyone has their opinions and thoughts, and there are many different modalities in...

I Have A Secret Credit Card… Now What? Step-by-Step Guide To Navigating This Situation

So, you have a secret credit card. Maybe getting it was a spontaneous decision - you saw a special promotion offering...

Spice Up Your Finances: How To Have A Life Changing Money Date With Your Partner Or Spouse

Hey there, money-savvy lovebirds! If you’re reading this, then it’s safe to assume you and your partner are quite the...

Start your Kentucky prenup today!

Is Kentucky the Right State to Choose?

There are a few factors that may make choosing KY as your state a little… er, complicated:

* Do you and your fiance live in different states?

* Do you plan to move to another state soon?

* Own two houses in different states?

You are free to choose whichever state you would like for your HelloPrenup prenup, but it is common practice and commonly accepted that you should choose the state in which you plan to reside as a married couple.

Your choice of state (this is what we call “choice of law”) determines which state will determine enforcement of your prenup in the event of a divorce.

Let’s say you live in Kentucky now, but you and your honey plan to move to either Florida or Massachusetts after you get married. Should your prenup be for Kentucky, Florida, or Massachusetts? Well, this is where ‘choice of law’ comes in. If you know, 100% that you are moving to Florida right away (because it’s warm, duh) and you plan to live in Florida as a married couple forever and ever, the choice is easier- Florida seems like a logical choice. But, if you are not sure whether you will move, when you will move, or where you will move? You should contact a licensed attorney to talk about what laws in those states look like.

Divorce Statute

How to end a marriage in KY

There are two ways to end a marriage in Kentucky: annulment or dissolution of marriage. An annulment ends a marriage that was invalid from the start. Grounds for annulment include coercion, bigamy, underage parties, related parties, a mentally incompetent spouse, or fraud. You may also file for legal separation, which does not end the marriage but achieves almost everything a divorce would, such as determining child custody, property division, and maintenance.

Only one party needs to begin the process of ending a marriage (but don’t get us wrong, it takes two to make it work!) If one party wants to end the marriage, it is within their sole right, and the other non-participating party does not have to agree to begin the process. If a non-participating spouse does not partake in the proceedings, a default judgment will be entered and force the divorce to proceed.

Residency requirements

Each state has residency requirements that must be fulfilled before you can divorce in that state. In Kentucky, this is the residency requirement:

- One spouse is a resident of Kentucky for at least 180 days before the divorce is filed.

>>For more fine print on the dissolution of marriage in Kentucky, read KY Rev Stat § 403.170