Millennials are known for breaking the norms—especially when it comes to estate planning and prenups. A recent study co-produced between the leading pioneer in self-serve, same-day prenups, HelloPrenup, and the leading online estate planning platform, Trust & Will, shows that millennials are leading the charge in thinking about and actively planning for their future. Unlike previous generations, younger people are planning for their future earlier and taking charge of their financial security.

The Importance of Prenuptial Agreements and Estate Planning

According to the study, millennials understand the financial implications of divorce and death more than previous generations and are taking steps to ensure their assets are protected. Prenups and estate planning are now a common conversation topic among young adults, whether they are considering marriage or already married. A prenup can help protect assets and determine how assets will be distributed in the case of divorce, while estate planning can ensure that a person’s wishes are carried out after death.

Why Are Millennials Creating Prenups?

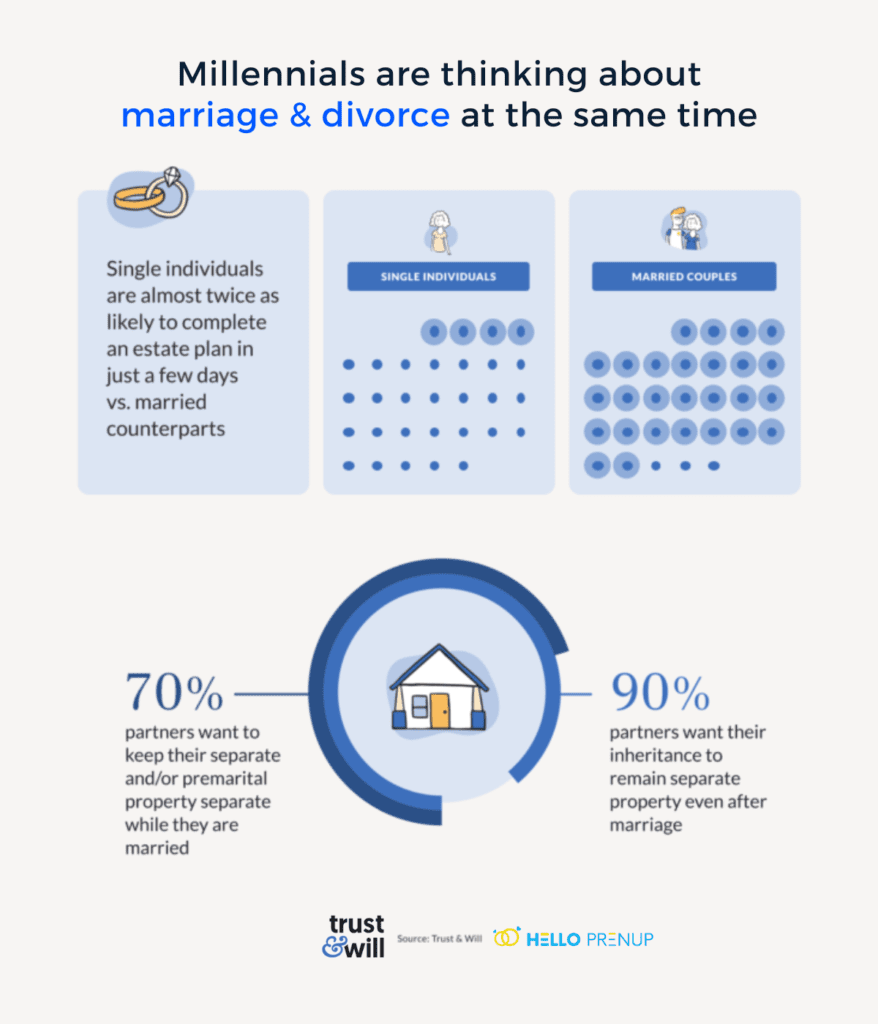

What are the main drivers leading millennials to get prenups(besides protecting their avocado toast budget)? Based on our study of over 5,000 people ages 18 and older, we found that nearly 90% of fiancés write into their prenups that inheritance must remain separate even after the marriage ends, especially for people with inheritances from $250,000 to $350,000.

In addition to keeping inheritance separate, 70% of fiancés want to keep their premarital property separate during marriage. This means that millennials are mandating that their “stuff” owned prior to marriage is kept separate, even during the marriage. “Stuff” can include anything from bank accounts to cryptocurrency to real estate.

But millennials aren’t keeping everything separate— nearly 80% of fiancés kept joint bank accounts during the marriage!

Why Are Millennials Setting Up Estate Plans?

Millennials are taking the initiative to start an estate plan for various reasons, including a change in marital status, starting a business, traveling abroad, and more. But of the many, here are the two most common reasons why young adults are prioritizing estate planning:

Marital Status Change

According to the study, 11.7% of millennials aged 25-34 and 5.3% of those aged 35-44 cited a change in marital status as the reason for starting an estate plan. This highlights the importance of prenups and estate planning for those entering into a new marriage.

Traveling Abroad

Traveling abroad is also a top reason why young adults start estate planning. The study found that 5% of 25-34-year-olds and 4.9% of respondents aged 35-44 noted traveling abroad as a reason for starting an estate plan.

The Bottom Line

In conclusion, the study shows that millennials are taking control over their estate planning, prenuptial agreements, and financial future. Whether they are getting married or traveling abroad, young adults today understand the importance of protecting their assets and ensuring their wishes are carried out after death. Prenups are also not a “scary” topic for couples anymore, as many millennials are realistic and understand the likelihood of divorce.

Key takeaway? Estate planning and prenups are no longer something just older generations do; it has become an essential aspect of millennials’ lives, and they are taking it seriously. Looking for more? Head to the full article and breakdown here.

Nicole Sheehey is the Head of Legal Content at HelloPrenup, and an Illinois licensed attorney. She has a wealth of knowledge and experience when it comes to prenuptial agreements. Nicole has Juris Doctor from John Marshall Law School. She has a deep understanding of the legal and financial implications of prenuptial agreements, and enjoys writing and collaborating with other attorneys on the nuances of the law. Nicole is passionate about helping couples locate the information they need when it comes to prenuptial agreements. You can reach Nicole here: [email protected]

0 Comments