Sharing data-driven prenuptial agreement insights & trends on today’s modern couples and their approach to prenups.

It’s 2024—love is in the air, online, and pretty much all around. And today’s modern couples aren’t just expressing their love through the traditional flowers & chocolates—they’re also showing their affection by discussing their hopes and dreams for their future and aligning on major topics like finances & prenups.

In an effort to understand these incredible couples and what motivates them while heading into marriage, we reviewed thousands of HelloPrenup couples who created a prenuptial agreement to further understand the current trends, what’s important to them, and how priceless getting on the same page financial prior to marriage really is. Here’s what the data shows:

Exclusive Insights from the Prenup Experts

Average Age of Our Prenup Customers

The majority of our customers seeking prenuptial agreements are young adults, with 75% falling between the ages of 18 and 39.

These Gen Z’s and Millennials are proactively planning for their financial future, recognizing the importance of not only protecting their assets by establishing clear financial boundaries before marriage. In addition, they’re normalizing having financial conversations early and often to ensure a healthy routine of communication early & often in their relationship.

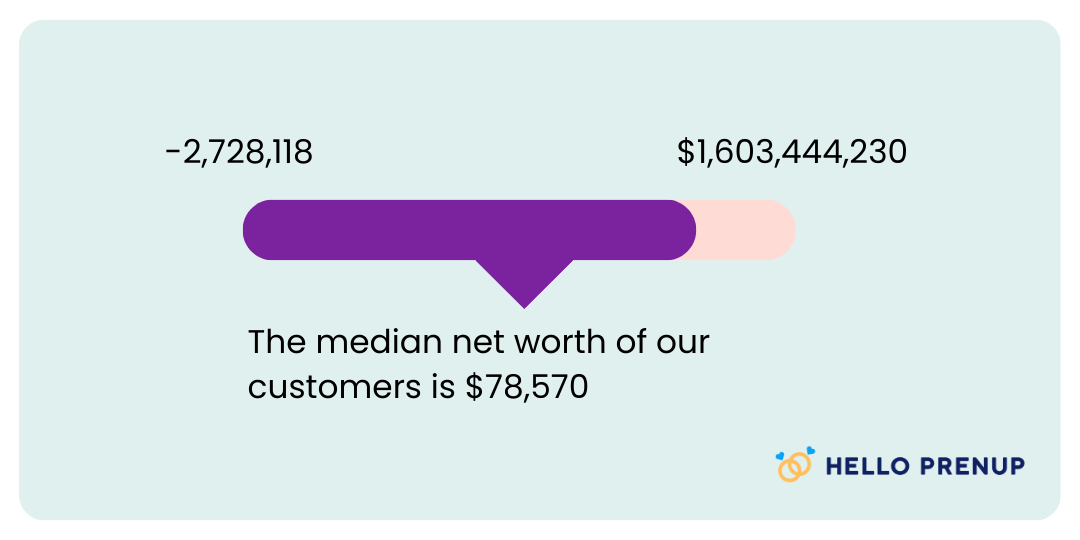

Average HelloPrenup Customer Net Worth

The net worth of individuals getting a HelloPrenup prenup spreads from -$2.7M to over $1.5B.

However, the median net worth of prenup fiances is ~$78,000.

This highlights that the traditional story of only higher net worth individuals are the ones prioritizing prenups has evolved to include every day couples who want the same basic legal protections and peace of mind.

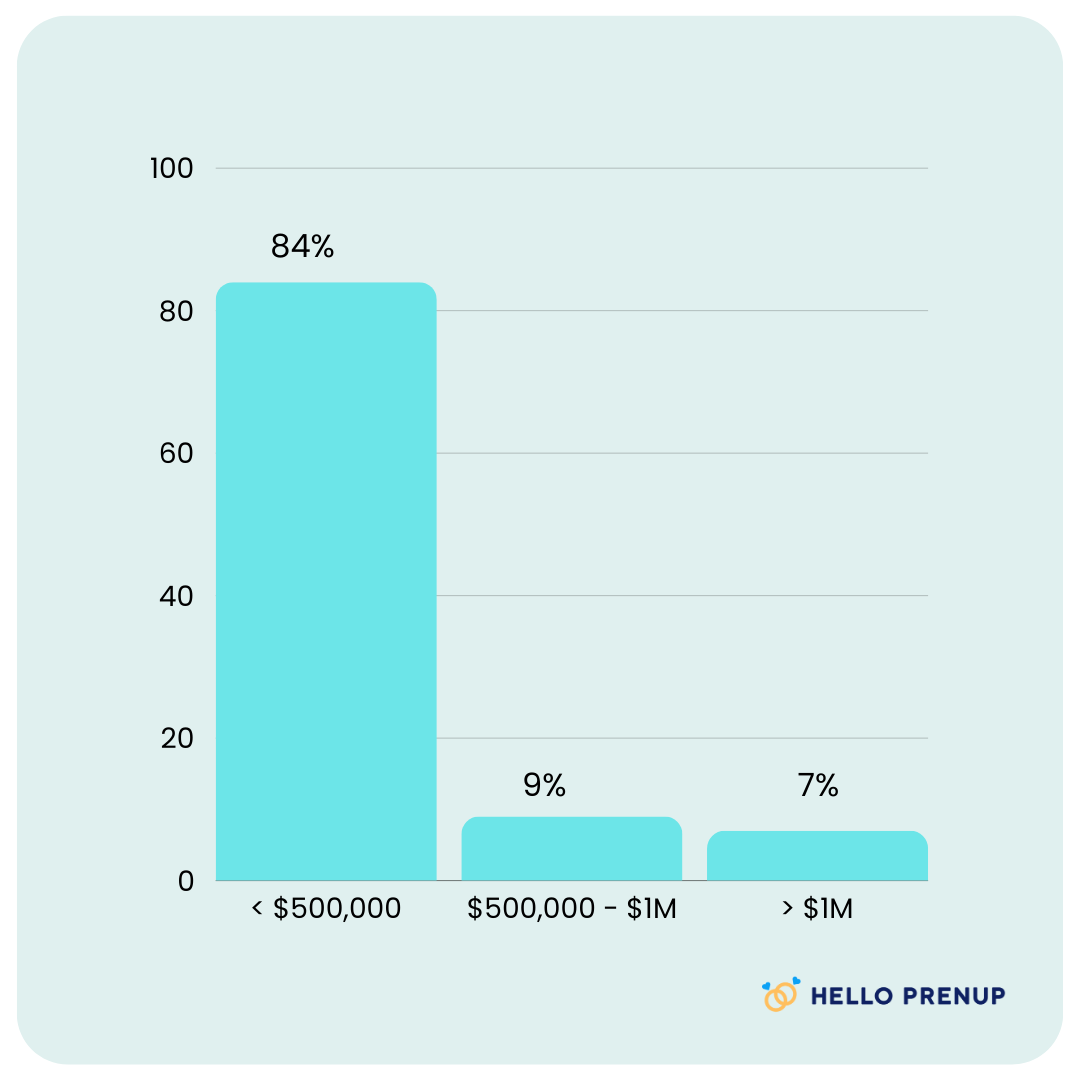

Average Net Worth of a Woman Getting a Prenup

84% of female HelloPrenup customers have less than $500,000 in liquid assets, with only 7% having a net worth over $1M.

This trajectory highlights the thoughtful approach women are taking to preserve their wealth while entering their marriage, debunking the myth that only wealthy women are entering into prenuptial agreements.

In fact, at HelloPrenup, 52% of women initiate the prenup process. This unprecedented stat highlights the initiative women are taking to have financial conversations early & ensure that their wealth is protected throughout their marriage while combating the gender pay gap & bracing for the Great Wealth Transfer.

Average Financial Disparity Between Couples

Financial imbalances are not a new proposition for getting a prenup. However, data reflects that couples have a smaller disparity gap with HelloPrenup couples having a median net worth disparity of ~$250,000.

This highlights the gap between partners entering into the marriage may not be as far off financially from each other as the traditional prenup couple where one party is significantly wealthier than the other.

How Couples Handle Premarital Assets While Entering Marriage

Our findings show that ~75% of couples choose to keep their premarital assets separate while entering the marriage rather than defaulting to their state’s laws.

This also includes any appreciation of their premarital assets while married.

This is one of the major reasons our modern couples invest in a prenuptial agreement since defaulting to state laws can result in assets being split 50/50, 70/30, 60/40, or another combination, depending on the state’s laws and the outcome of the case.

It shows the consistent trend that couples who want to keep their premarital assets separate want to do so regardless of if the marriage lasts or not (reflecting the importance of each spouse preserving any wealth they’re bringing into the marriage).

How Couples Handle Marital Assets While Married

79% of respondents plan to share a joint bank account with their future spouse. So while they may keep premarital assets separate, they do intend to share some financial obligations once married.

This spotlights the control couples crave when it comes to financial contributions. They do want to have some sort of financial asset they contribute to, but they want to control the outcomes of those contributions by contracting around their state’s default laws that may not work for the goals of their marriage.

Property Ownership Before Marriage

According to our data, 84% of our customers do not own property with their partner before marriage.

Which means, the prenup is ideal for creating conversations around each other’s financial statements and spending philosophies prior to entering into their partnership.

By getting a prenup, they can get on the same page financially prior to tying the knot without comingling any unwanted assets and letting their government potentially decide the fate of those assets.

Average Debt & Liabilities

Besides each partner protecting their own premarital assets they’re entering the marriage with, and keeping premarital appreciation separate while married, ~95% of couples keep premarital debt separate to protect each other from passing on their pre-marriage liabilities and potentially converting to marital.

In fact, the median debt amount of our users is $30,000.

Of the customers that registered some debt in the Financial Disclosures of their HelloPrenup prenup, 75% have a debt amount between $0 and $103,993.

This highlights the empathetic intent and awareness partners have entering into their marriage by taking ownership of their liabilities prior to legally binding themselves to their spouse.

Children & Family

When asked about their family status, 78% of respondents stated that they do not have any children.

Though you cannot contract around child support in a prenuptial agreement, it shows the family dynamic of the average couples entering into their agreements and any financial obligations they may bring into their marriage.

Average Inheritance

75% indicated a potential inheritance value between $1 and $1,500,000.

And of the 75% who will receive the potential inheritance, ~90% of them kept their inheritance separate while married.

This almost unanimous stat shows the independent thinking partners have while preserving their wealth and ensuring their financial future is ripe for retirement, regardless of when they inherit it.

Join the thousands of couples creating their prenup today.

Create your free account now.

Key Takeaways:

TL;DR—You’re not alone in wanting to protecting your financial future.

After sifting through the data of thousands of couples across 30+ states, it’s abundantly clear:

👉 Couples crave peace of mind prior to marriage.

They’ve converted the traditionally taboo topic as a newly wed to-do with no signs of slowing down.

In addition—47% of engaged couples invest in a prenup. Meaning, you can feel confident in wanting to protect your financial future, too.

At HelloPrenup, we specialize in creating tailored prenuptial agreements that cater to the unique needs of every couple—regardless of networth, background, or circumstance.

We support a diverse range of financial situations, and pride ourselves on supporting couples through a collaborative (not adversarial) process designed to bring them closer together and feel strongest on their wedding day and the years ahead.

We believe couples know their relationship best, and by empowering them with an affordable, accessible way to get basic legal protections we can support them in establishing healthy habits to ensure the strength and longevity of their marriage.

Want more information? Say hello at hello@helloprenup.com.

2024 Family Law Industry Insights

Case Study · Communication

HelloPrenup 2024 Family Law Attorney Survey

Industry insights from Prenup Attorneys across the United States.

2023 Prenup Industry Insights

Case Study · Communication

HelloPrenup 2023 Prenuptial Agreement Study

The data has spoken: Market trends, industry insights, and perception altering statistics.

More About Prenups

Premarital Counseling Topics

Getting engaged is thrilling. You’re choosing your partner, celebrating your commitment, and...

How to have realistic expectations for marriage

As we grow up, we’re absorbing ideas about marriage from everywhere—our parents/caregivers,...

Just Got Engaged on Valentine’s Day? Here’s What to Do Next

The day of love just got a little sweeter with your engagement. If you got engaged on Valentine’s...

Do I Need a Prenup Lawyer in Mississippi?

Getting married in Mississippi can feel exciting and hopeful. Picture sunsets along the Magnolia...

Who Signs a Prenup?

At first glance, the question of who signs a prenup seems simple. The answer, however, is layered...

How to emotionally reconnect in a relationship

Every couple goes through seasons where they feel in sync with no effort, and others when that...

You’re writing your life story together. Make sure you’re on the same page.

Sign-up. Complete prenup. Get married.