With the emergence of fintech and upgrades in smartphones, access to online investing has never been easier. With that comes great opportunities and equally great risks. So before we delve into the juiciness of investing, let’s first clarify why you might even consider investing and what exactly we mean when we say “investing.”

Why invest? (Using an example)

One of my all-time favorite examples to share is one of a reimagined Disney financial fairytale.

Once upon a time, there were two fabulous Queens running their Queendoms.

Queen B was wise and knew she could make her money work for her. Queen Z was fabulous too, but didn’t know her money could work for her, so instead always worked hard for her money.

Queen B read articles like this one and became financially savvy. She took control of her money at age 30, investing $400 every month in the stock market for 35 years until her fabulous years of retirement arrived. (We’ll use the S&P 500 Index to represent the markets in this case and assume a pre-inflation adjusted return of 10%.)

Queen Z also took control of her money at age 30, but instead of investing, she saved her $400 every month in a high-yield savings account, growing at 2% every year.

In their fabulous age of 65, Queen B and Queen Z meet over cocktails and begin sharing about the state of their Queendom finances

Let’s see what happened…

Queen B’s investment account had grown to $1,518,655.

Queen Z’s savings account had grown to $243,019. That’s $1,275,636 LESS than Queen B!

That’s the difference investing your money can make, and why you are here reading this now–this can truly be a life-changing moment for you.

What is investing?

With all that said, let’s dive into the world of investing and how to make it work for you!

Let’s be real; saying “investing” is like saying “working out.” Sure, you may have a general understanding of what I’m talking about, but the truth is there are a million iterations of what I actually mean, and unless I clarify, you could turn up to my workout session with your yoga mat while I’m standing there in my hiking boots!

In our ultra online world, there are so many ways to invest your money, some great, some sketchy, and some which are outright scams! I have seen one too many fake IG accounts with my photos splashed alongside silly photos of fake returns aimed at convincing people that this one investment will double their money or this one crypto coin or hot stock is about to take off, so don’t miss out, better invest big now!

As you’ll hear me say time and time again, the first rule of investing is: don’t invest in what you don’t understand, and if it seems too good to be true, it likely is!

It’s your money, after all, and you have a responsibility to ensure it’s taken care of. Not to be fooled by the shiny allure of big returns or get-rich-quick promises.

The one thing I can guarantee is that anyone promising “you’ll get rich quick” is simultaneously whispering, “You’ll get broke faster!”.

When I speak about investing, I’m speaking about long-term investing. The aim is consistent, steady, growing returns. Everything else is gambling, hoping, and wishing.

There are a lot of fraudsters and well-polished salespeople within the financial industry. Some are ignorant and untrained; others are ill-intended and criminals. However, whatever side of the scale they’re on, you want to run a mile from them and keep running!

That’s why I want to ensure you’re equipped with the fundamentals in understanding what investing is and how it works, so you know exactly how to make it work for you and never fall victim to the financial cowboys out to take advantage of people’s lack of understanding.

You’ll never hear me saying, this is how you time the market or buy and sell using this strategy to make the biggest profit. No one can do that. Even those who guarantee they can really can’t.

You’ll never hear me talking about the next hot stock to invest in either. No one really knows. People can guess and may be right. However, if you stay in Vegas long enough, you’re sure to win something. Just don’t confuse that for talent, intelligence, or some ability to know better than you. It’s luck, and luck is not repeatable. In fact, the false confidence it creates usually just leads to even greater losses!

So now that I know we’re on the same page let me share with you a crash course in finance fundamentals so you can confidently begin your investment journey.

There are 4 key rules in your path as a beginner investor:

- Understand the financial markets

- Identify your investment opportunities

- Craft your unique action plan

- Take action and implement your plan

1. Understanding the Financial Markets

Remember, rule #1 of investing is: don’t invest in what you don’t understand. So, if you’re preparing to invest in the financial markets, understanding what they are and how they work is an essential place to start.

What are the financial markets?

Have you ever been to a farmers market on the weekend? It’s one of my favorite things to do. Strolling around the different stands, watching the hustle and bustle of the traders – the farmers selling to the people buying.

If you can picture this, then you already know more about the financial markets than you may expect. That picture is one of a ‘market’ where products are being ‘traded.’

If we swap the farmer’s products for financial products, then, in essence, that is what the financial markets are. A place where investors buy and sell i.e., trade, different types of financial products.

“Financial market” is the umbrella term we use for describing the many different types of markets that exist. For example:

- Stock Market: where stocks are traded i.e., bought and sold, in publicly listed companies

- Bond Market: sometimes referred to as the debt markets, fixed income markets, or credit markets, are where investors trade the debt of companies or countries.

- Forex Markets: the foreign exchange markets where investors trade currencies.

The most commonly referred to type of market is the stock market, so let’s take a closer look there.

Stock market is another umbrella term used to describe the places – the markets and exchanges – where stocks, also called shares, or equity, are traded – which just means bought and sold – in publicly listed companies. For a company to become public, it needs to list on what is called a Stock Exchange.

The reason for emphasizing publicly listed companies is that when you become an investor, you’ll be able to log on to your investment account and trade in companies like Apple, buying or selling their shares. However, you would not be able to go online and buy or sell shares in my company, The Witch of Wall Street, because my company is privately owned.

How do the financial markets work?

Most people think the markets move like a roller coaster, up, down, and sideways in the most unpredictable way. However, the markets move more in alignment with the seasons than they do some vomit-inducing, adrenaline-pumping rides! Let’s take a closer look to see…

Many people view investing in the stock market as a risky bet, one they’d be better off avoiding in exchange for keeping their money nestled in a bank account.

You may have even heard stories of others who’ve lost money in the stock market and wonder why anyone would choose to invest there ever again.

Possibly, you’ve turned on CNN during an economic downturn only to see the warning signs of the flashing red arrows, triggering fear and panic in the hearts of investors everywhere!

But none of this is true.

The actual truth is most investors have no idea how the markets work but continue to invest regardless, defying our very first rule: don’t invest in what you don’t understand.

The reality is the stock market will rise and fall, and rise and fall, but generally rise over time.

The stock market moves in cycles, like the seasons, from summer to winter and back to summer.

When stock prices are going up, and the market is in the summer season, uninformed investors expect it will never change and buy, buy, and make risky bets. Equally, when stock prices are going down, and the market is in the winter season, they expect it will never change, so sell, sell, and lose big in the process.

These investors, unfortunately, don’t understand the key principle of investing. Markets move in cycles. Summer will come, and so too will winter. We just don’t know when or how long either will last for, and quite frankly, by adopting a long-term approach to investing like I suggest, you don’t have to!

2. Identify your Investment Options

Now that you have a more in-depth understanding of how the financial markets work let’s take a look at the different ways to invest your money in them. There are many opportunities available, but as you’ll soon find out, there’s a way to simplify your investing approach to make it easy to implement and a breeze to track long term.

The typical types of investments you might have heard about range from stocks, bonds, and REITs to commodities, crypto, and funds.

What are these investments, and should you consider investing in them?

To fast-track your finance 101 journey, let me cut to the chase by sharing that one of the best options for most investors is funds, specifically index funds or their twin, exchange-traded funds (ETFs).

What is an index fund?

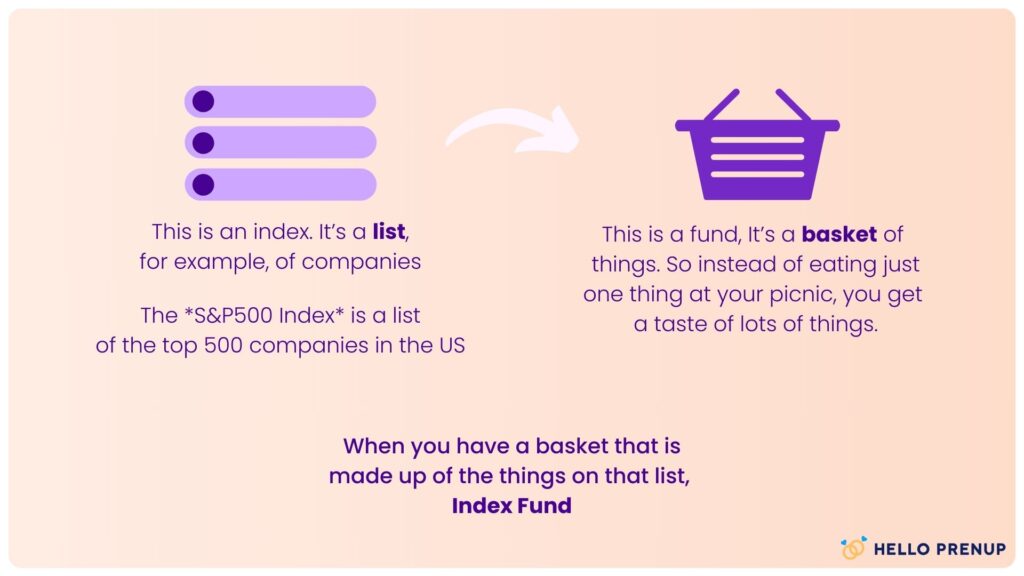

When a group of companies, or any financial product, are put together in a basket, and you can invest in a piece of that basket, it is called a fund. An index fund follows a specific index, which is just a list.

For example:

- The FTSE 100 Index follows a list of the top 100 companies in the UK.

- Dow Jones Industrial Average Index follows a list of the top 30 companies in the US.

- S&P 500 Index follows a list of the top 500 companies in the US.

- NASDAQ Index follows a list of the top 1000 US tech companies.

Funds are then created to track these lists and give investors like you the ability to get exposure to all the companies on that list, or “index.” This is called an Index Fund.

- The FTSE 100 Index Fund holds the stocks that are listed on the FTSE 100 Index, which is a list of the top 100 companies listed on the London Stock Exchange in the UK.

- The S&P 500 Index Fund holds all stocks listed on the S&P 500 index, which is a list of the top 500 companies listed on stock exchanges in the US.

There are Index Funds for many things, including top companies, ethical companies, female-led companies, ESG companies, and the list goes on.

The Index Love Story

I admittedly have a Taylor Swift love story with index funds for many reasons, including:

- Index funds give you exposure to a variety of stocks at once, so it comes with built-in diversification

- Are designed to match market returns

- Are passively managed, so charge lower fees than actively managed funds

- Have low operating expenses and low portfolio turnover

- Makes very few trades, so transaction costs are very low

- Due to the buy-and-hold strategy, index funds also minimise taxes

3. Craft your unique action plan

Merging your newfound understanding of what the financial markets are with your insight into what the best investment opportunities are for you, it’s time to craft your unique investment strategy. This will be nuanced for each individual investor, but it’s incredibly empowering to understand what the journey could even look like for you in order to realize it’s not as daunting or out of reach as you may currently feel.

There are 7 key steps to take on your short journey to becoming an investor:

- Know your risk profile. This will determine how much money you’re going to invest into the different investment options available to you.

- Open an account with your chosen online broker and choose your tax-sheltered account so your investments can grow most efficiently.

- Deposit money into the tax-sheltered accounts. Be aware that this is not investing! This is just moving money. Many newbie investors fall into this trap and leave their money sitting there doing nothing for years but losing value.

- Choose which Index Funds or ETFs you want to invest in and how much to invest in each, based on your unique risk profile.

- Make your investments by buying or ‘dealing’ the allocated amount of each fund.

- Automate the process if it’s available on your chosen online broker account, or repeat Step 5 during your monthly money date.

- Once a year, rebalance your portfolio to bring it back in line with your risk profile. For example, if, based on your unique risk profile, you invested 60% of your portfolio in funds made up of stocks and 40% in funds made up of bonds, and at the year’s end, your funds of stocks had grown to represent 85% of your portfolio, you would then sell a portion of your stock funds to bring it back in line with your 60/40 split.

Where to next?

Beginning any new journey can feel challenging and daunting to begin with, so it’s important to remember that moving forward slowly and steadily, step-by-step, will ensure you arrive at your destination of becoming that confident investor whose money works for them.

Keep focused on your goals, schedule your monthly money dates, and avoid the allure of get-rich-quick schemes, which lead to financial disaster for so many.

If you want to kick-start your investing journey, be sure to check out this free resource where I share your step-by-step guide on how to get started now. LauraTynan.com/investing_minibook.

Laura Tynan is the founder of The Witch of Wall Street, a personal finance and investing community, where women are shown how to manage, multiply and manifest money, using simple strategies. Laura holds a BSc Hons in Finance, is a Chartered Accountant, and is certified in EFT Tapping, Breathwork, and RRT. She has been recognized by the Financial Times as a Top 20 Future Female Leader and by Yahoo! Finance as a Global Champion of Women in Business. She is a multi-award-winning speaker who has spoken at, and been featured in, Forbes. Laura hosts The Witch of Wall Street podcast and is the author of the personal finance and investing book for women, by the same name, which is available now on Amazon.

0 Comments